Topic outline

- Welcome to E-Commerce

Welcome to E-Commerce

Course description

This course describes the opportunities and markets that exist for electronic commerce, including B2B and B2C, and electronic government. It also looks at the internal organization of work, using intranets and groupware, and the effect of the introduction of such technology on operations and culture. The course introduces the technologies underpinning electronic commerce.

Course Objectives

Students will learn to:

1. Design business processes relevant to an electronic commerce strategy.

2. Evaluate the major organizational impediments to realizing an electronic commerce strategy.

3. Assess the costs and benefits of an electronic commerce strategy.

4. Define the information and technical architecture required to realize an electronic commerce strategy.

Learning Outcomes

By the end of this course, the student should be able to:

1. Design business processes relevant to an electronic commerce strategy.

2. Evaluate the major organizational impediments to realizing an electronic commerce strategy.

3. Assess the costs and benefits of an electronic commerce strategy.

4. Define the information and technical architecture required to realize an electronic commerce strategy.

Detailed Course Content

Topics Hours

Sub Topics

What is E-commerce

• E-commerce revolution

• E-commerce history

• Understanding e-commerce – organizing themes

• Case-study

• Project

E-commerce Business Models and Concepts

• E-commerce business models

• Major business-to-consumer (B2C) business models

• Major business-to-business (B2B) business models

• Business models in emerging e-commerce areas

• How the Internet and the Web change business: strategy, structure, and process

• Case-study

• Project

The Internet and World Wide Web: Ecommerce Infrastructure

• The Internet – technology background

• The Internet today

• Future Internet infrastructure

• The World Wide Web

• The Internet and the Web –features

• Case-study

• Project

Building an E-commerce Web Site

• Building an e-commerce web site – a systematic approach

• Choosing server software

• Choosing the hardware for an ecommerce site

• Other e-commerce site tools

• Case-study

• Project

Online Security and Payment Systems

• The e-commerce security environment

• Security threats in the ecommerce environment

• Technology solutions

• Management policies, business procedures, and public laws

• Payment systems

• E-commerce payment systems

• Electronic billing presentation and payment

• Case-study

• Project

E-commerce Marketing Concepts

• Consumers online – The Internet audience and consumer behavior

• Basic marketing concepts

• Internet marketing technologies

• B2C and B2B e-commerce marketing and branding strategies

• Case-study

• Project

E-commerce Marketing Communications

• Understanding the costs and benefits of online marketing communications

• The web site as a marketing communications tool

• Case-study

• Project

Ethical, Social, and Political Issues in Ecommerce

• Understanding ethical, social, and political issues in ecommerce

• Privacy and information rights

• Intellectual property rights

• Governance

• Public safety and welfare

• Case-study

• Project

Online Retailing and Services

• Analyzing the viability of online firms

• E-commerce in action – E-tailing business models

• The service sector – offline and online

• Online financial services

• Online traveling services

• Online career services

• Case-study

• Project

Online Content and Media

• The online publishing industry

• The online entertainment industry

• Case-study

• Project

Social Networks, Auction, and Portals

• Social networks and online communities

• Online auctions

• E-commerce portals

• Case-study

• Project

B2B E-commerce – Supply Chain

Management and Collaborative

Commerce

• B2B e-commerce and supply chain management

• Net marketplaces

• Private industrial networks

• Case-study

• Project

TOTAL

Mode of Delivery

· Lectures

· Reading assignments

· Presentations

· Lab practical exercises

· Blended learning

INSTRUCTIONAL MATERIALS AND/OR EQUIPMENT

· Whiteboard and Markers

· LCD Projectors

· CD5, and DVDs

COURSE ASSESSMENT

· Continuous assessments tests

20%

· Group and individual project (course work)

20%

· End of Semester Examination -

60%

Total

100%

READING MATERIALS

1. Kenneth Laudon and Carrol Guercio Traver. E-Commerce: Business Technology, Society. 6th ed., Pearson Education, 2009.

3. Efraim Turdan, Jae K. Lee, David King, Ting Peng Liang and Deborrah Turban. Electronic

4. Martin .V. Deise, Conrad Nowikow, Patrick King and Amy Wright. Executive's Guide to EBusiness – From Tactics to Strategy. ISBN 0-471-37639-6, Wiley, 2000.

5. Ravi Kalakota, Andrew B. Whinston. Electronic Commerce: A Manager's Guide. 2nd ed.,Addison-Wesley, 1996.

Lecturer: Prof. Zake

Mobile/ WhatsApp: +256 788 485 749

email: tebiggwawo@gmail.com

- Assignments

Assignments

Give a summarised history of e-commerce.

- Lectures

- Introduction - What is E-commerce?This topic

Introduction - What is E-commerce?

History.

History of e-commerce dates back to the invention of the very old Nation of “sell

and buy” , electricity cables computers modems and the internet.

e-commerce became possible in a 1991 when the internet was opened commercial

use. Since that date thousands of businesses I have taken up residence at websites.

At first, the term E-Commerce meant the process of execution of commercial

transactions electronically with the help of technologies such as electronic data

interchange (EDI) and electronic funds transfer tuna(EFT) , which gave an

opportunity for users to exchange business information and 2 electronic

transactions. The ability to use these Technologies appeared in the late 1970 s and

allowed business companies stations to send commercial documentation

electronically.

- E-commerce Models and Concepts

E-commerce Models and Concepts

E-commerce business models

• Major business-to-consumer (B2C) business models

• Major business-to-business (B2B) business models

• Business models in emerging ecommerce areas

• How the Internet and the Web change business: strategy, structure, and process

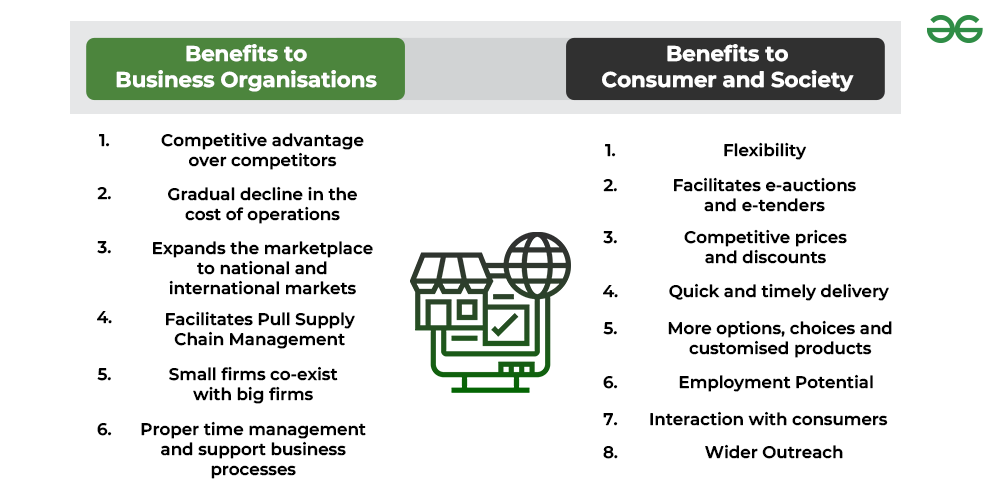

E-commerce, also known as Electronic Commerce, refers to the purchase and sale of goods and services through the Internet. The first online transaction occurred in 1994 when a guy sold a Sting CD to a friend via his website Net Market, an American retail platform. This is the first case of a consumer purchasing a product from a business over the World Wide Web, sometimes known as e-commerce. After that, e-commerce evolved to make it easier to locate and purchase products through online merchants and marketplaces.

E-commerce is supported by technology assets such as supply chain management, internet marketing, online transaction processing, a data management system, and an inventory management system. Not only that, even live chats, chatbots, and voice assistants all empowered e-commerce. E-Commerce is defined as the execution of business on an online platform using digital devices, such as mobile phones, computers, tablets, and the internet.

Reference: https://www.geeksforgeeks.org/what-is-e-commerce-explain-benefits-and-types-of-e-commerce/

1. B2B Commerce:

Both parties involved in e-commerce transactions are business firms, hence the name B2B, which stands for business-to-business.

The creation of utilities or the delivery of value requires the interaction of a business with a number of other business firms, which may be suppliers or vendors of various inputs, or they may be a part of the channel through which a firm distributes its products to consumers. For example, the production of an automobile requires the assembly of a large number of components, which are manufactured elsewhere, either locally or overseas.

A computer network is used to place orders, monitor the production and delivery of components, and make payments. Similarly, a company can strengthen and improve its distribution system by exercising real-time (as-it-happens) control over its stock-in-transit as well as that with various middlemen in various locations. For example, each shipment of goods from a warehouse and stock on hand can be tracked, and replenishments and reinforcements can be initiated as needed.

Around 80 per cent of the total share of transactions is comprised of B2B transactions. Sharing of information, Commercial negotiations and Distribution of goods are some of the B2B transactions.

2. B2C Commerce

B2C (business-to-customers) transactions involve business firms on one end and their customers on the other. Although online shopping is the first thing that comes to mind, it is important to remember that selling is the outcome of the marketing process. Marketing begins before a product is offered for sale and continues after the product is sold. As a result, B2C commerce entails a wide range of marketing activities such as identifying activities, promoting, and sometimes even delivering products that are carried out online.

e-business enables these activities to be carried out at a much lower cost but at a much faster pace. For example, an ATM helps to withdraw money 24×7 in a convenient and fast manner.

Furthermore, the B2C variant of e-commerce allows a company to communicate with its customers around the clock. Companies can use online surveys to find out who is buying what and how satisfied their customers are. C2B commerce is a reality that allows consumers to shop whenever and wherever they want. Customers can also use call centres set up by companies to make toll-free calls to make inquiries and lodge complaints 24 hours a day, seven days a week. Selling and Distribution of goods, conducting surveys, after-sale services, promotional activities, etc., are B2C transactions.

3. C2C Commerce

C2C Commerce consists of the transactions taking place between two or more customers. For example, you could sell used books or clothes for cash or in exchange for goods. People can search for potential buyers all over the world because of e-commerce. Quikr, OLX, are such platforms where customers sell their goods and services to other customers.

Furthermore, e-commerce technology provides market system security to such transactions, which would otherwise be missing if buyers and sellers interact in the anonymity of one-to-one transactions. An excellent example of this can be found on eBay, where consumers sell their goods and services to other consumers. Several technologies have emerged to improve the security and robustness of this activity. For beginners, eBay allows all sellers and buyers to rate one another.

The payment intermediary is another technology that has emerged to support C2C activities. PayPal is an excellent example of this type, rather than purchasing items directly from an unknown, untrustworthy seller; instead, the buyer can send the money to PayPal. The seller is then notified by PayPal that the funds will be held for them until the goods have been shipped and accepted by the buyer.

4. Intra B-Commerce

The interaction and dealing among various departments and persons within the firm is known as Intra B-Commerce. An intranet is used to interact and deal between various departments and firms within a firm. Intra B-Commerce has facilitated flexible manufacturing. For example, finance department may interact regularly with marketing department within a firm. Intra-B-commerce transactions are conducted for Inventory and cash management, reporting by subordinates to superiors

, human resource management, recruitment and selection, and for training, development, and education. Nowadays, companies use VPN, which is, Virtual Private Network technology, which helps employees access the organisation’s network and enable work from anywhere through network.

Last Updated : 06 Apr, 2023 - The Internet and World Wide Web: Ecommerce Infrastructure

The Internet and World Wide Web: Ecommerce Infrastructure

• The Internet – technology background

• The Internet today

• Future Internet infrastructure

• The World Wide Web

• The Internet and the Web –features

The Internet - technology background

The original purpose of the Internet, when it was conceived in the 1960s, was to link large mainframe computers on different college campuses. This kind of one-to-one communication between campuses was previously only possible through the telephone system or private networks owned by the large computer manufacturers.

The E-Commerce Infrastructure describes the technology, content, and data used to support e-commerce operations and deliver services to business partners and customers.

Important concepts about the Internet.

Learn why it is important for your business to have a well-defined e-commerce infrastructure.

- Building an E-commerce Web Site

Building an E-commerce Web Site

• Building an e-commerce web site – a systematic approach

• Choosing server software

• Choosing the hardware for an ecommerce site

• Other e-commerce site tools

The two most important management challenges in building a successful e-commerce site are 1.Develop a clear understanding of your business objectives 2.Choosing the right technologies to achieve those objectives Thus, effective plan and knowledge base of the above factors will help in making sound management decisions.

- Online Security and Payment Systems

Online Security and Payment Systems

The e-commerce security environment

What is eCommerce security? E-commerce security is a set of guidelines that ensures safe online transactions. Just like physical stores invest in security guards or cameras to prevent theft, online stores need to defend against cyberattacks.

Security threats in the e-commerce environment - Reference: E-Commerce Security Threats and Their Solutions: https://www.americanexpress.com/en-ca/business/trends-and-insights/articles/ecommerce-security-threats-and-their-solutions/

1. Financial fraud

Financial fraud takes several forms. It involves hackers gaining access to your customer's personal information or payment information, then selling that information on the black market. It also involves fraudsters using stolen credit card information to make illegitimate purchases from your e-commerce store.2. Phishing

Your customers are the target in a phishing scam, where a fraudster sends messages or emails pretending to be you with the goal of obtaining their private information. These messages may contain logos, URLs, and other information that appears to be legitimate, but it won't be you sending it. They'll ask customers to verify their account by logging in and then use the information to steal personal data.3. Spamming

In an attempt to obtain personal information—or to affect your website's performance—spammers may leave infected links in their comments or messages on your website, such as on blog posts or contact forms. If you click on the links, they can take you to a spam website that exposes you to malware.4. Malware

Malware refers to malicious programs such as spyware, viruses, Trojan horses, and ransomware. Hackers install it on your computer system and spread it to your customers and administrators, where it might swipe sensitive data on their systems and from your website.5. Bad bots

People are generally aware that bots are all over the Internet, obtaining information about our habits and behaviours. Your competition, however, could use bots to gather information about your inventory and prices. They then use that information to change their prices. Or hackers can send malicious bots to e-commerce checkout pages to buy large amounts of a product and scalp it for up to 10 times the list price.6. Distributed denial of service (DDoS) attacks

Distributed denial of service attacks happens when your servers receive an overwhelming amount of requests from various IP addresses—usually untraceable—that cause your server to crash. That means your e-commerce store isn't available to visitors, which disrupts your sales.7. Fake return and refund fraud

Fraudsters can obtain money from you by committing fake returns and refund fraud in many ways. Some use a stolen credit card to purchase merchandise, then claim that the card is closed and request a refund to another card. Others use counterfeit receipts to request refunds for items they haven't purchased.8. Man-in-the-middle attacks

With technology evolving, so are hackers' schemes. Man-in-the-middle attacks allow the hacker to listen in on the communications of e-commerce website users. These users are tricked into using a public wireless network, enabling hackers to access their devices and see their browsing history. They can also access credit card information, passwords, and usernames.Technology solutions

Address Verification Systems

An address verification system compares the customer's billing address against the credit card issuer's information on file. If the addresses don't match, the system prevents the transaction from going through.

Stronger passwords

Many e-commerce businesses don't require their users to provide strong passwords, making client accounts easy to hack. Implement a system that requires your customers to use strong passwords with letters, numbers, and symbols to make their accounts difficult to hack into. While you're at it, make sure you and your administration have secure passwords, and ensure user access is restricted to those who need it. When employees are terminated, revoke all system access immediately.Payment gateways

Rather than being responsible for storing and securing your clients' information, use a third party such as PayPal or Stripe to handle payment transactions separately from your website. This keeps your customers' information safer and makes you less attractive to hackers.HTTPS

Many e-commerce businesses still use HTTP protocols, which are vulnerable to attacks. HTTPS is more secure and protects sensitive information. Before switching to HTTPS, you'll need an up-to-date SSL certification from your hosting company. It's worth it to give your customers peace of mind and protect their information—and your business.Management policies, business procedures, and public laws - See link below

Payment systems

Payment & settlement systems are mechanisms established to facilitate the clearing and settlement of monetary and other financial transactions. Secure, affordable & accessible payment systems and services promote development, support financial stability, and help expand financial inclusion.

Payment systems, Financial Market Infrastructures (FMIs) and digital financial services (DFS) help expand financial inclusion, foster economic development, enable digital economy, and support financial stability. Given this, promoting safe, reliable, and efficient domestic and cross-border payments systems, and FMIs is an integral component of the World Bank Group’s (WBG) work to reduce poverty and boost shared prosperity.

The work of the WBG on these topics span development of legal/regulatory framework, large value payment systems, securities settlement, foreign exchange settlement, retail payment systems, government payments, cross-border payments, oversight and cooperation, as well as the latest developments in fintech notably crypto, central bank digital currency, and open banking. Over the last two decades, the WBG has contributed to the global payment systems knowledge agenda and has supported payment systems reforms in over 120 countries through:- The development of Payments Systems Strategies and formulation of reforms.

- The establishment of appropriate institutional arrangements for central banks / other regulators for steering National Payments System (NPS) development.

- The formulation of international standards related to payment systems, alongside other standard setting bodies.

- Global convening.

- Technical and financial assistance for implementation of specific payment system components such as Automated Clearinghouses (ACH), Real Time Gross Settlement (RTGS) Systems, Fast Payment Systems (FPS), Central Security Depositories (CSD), Securities Settlement Systems (SSS).

The WBG delivers technical and financial assistance to public sector authorities including financial sector authorities, central banks, securities commissions, as well as other supervisory and regulatory authorities, and in partnership with public authorities to specific market level initiatives.

The WBG engages private sector and public sector donors such as the Bill & Melinda Gates Foundation, the United Kingdom’s Foreign, Commonwealth & Development Office (FCDO), AusAID, Global Affairs Canada, and the Swiss Secretariat for Economic Affairs (SECO). Globally, WBG partners include, among others regional development banks; standard setters such as the Bank for International Settlements (BIS), particularly the Committee on Payments and Market Infrastructures; the International Organization of Securities Commission (IOSCO); the International Monetary Fund (IMF) to develop global standards, guidance, best practices, and to conduct formal assessments such as the Financial Sector Assessment Program (FSAP). Furthermore, the WBG has developed structured engagements with various global private sector players and convenes public-private partnership fora.

Development and implementation of standards for financial market infrastructure and payments systems

At the country-level, the WBG helps countries to adopt international best practices and standards such as CPMI–IOSCO Principles for Financial Market Infrastructures (PFMIs). It also contributes to the work of the standard-setting bodies by participating in working groups that develop and monitor implementation and adequacy of standards, leading joint task forces such as CPMI-WB Payment Aspects of Financial Inclusion and CPMI-WB General Principles for International Remittances, and disseminating standards and guidance through convenings such as the biennial Global Payments Week and the Regional Payments Weeks.

Payment aspects of financial inclusion (PAFI)

Having access to useful and affordable financial products and services– transactions, payments, savings, credit, and insurance – is a hallmark of financial inclusion. Accessing a transaction account and being able to make/receive digital payments are considered as an entry point to the broader set of digital financial services and financial inclusion overall. The CPMI-WBG Report on Payment Aspects of Financial Inclusion (PAFI) application guidance serves as a framework based on which the WBG provides technical assistance on several intersectional aspects of financial inclusion and payments such as: legal/regulatory framework, financial infrastructures, transaction account and payment product design, readily available access channels, awareness and financial literacy, and leveraging large volume recurrent payment streams.

International remittances cost reduction and monitoring

Payment flows such as remittances are three times larger than official development assistance and steadier than both private debt and portfolio equity flows. In more than 60 countries, remittances account for 3 percent or more of the Gross Domestic Product (GDP), and small/fragile states are more heavily dependent on remittances. As such, it is critical that both, remittance senders and receivers have access to a multitude of payment methods and channels in order to deliver and receive remittances in an affordable and fast manner. This requires interventions and coordination at the domestic and regional/global level. To support those objectives and more broadly the global remittances agenda, the WBG provides assistance and engages in this area by:- steering the global efforts through the Global Remittances Working Group;

- monitoring the cost of international remittance services through the Remittance Prices Worldwide (RPW) database and disseminates knowledge;

- promoting innovative approaches to undertaking remittances reforms, including through Project Greenback 2.0;

- undertaking assessments of the remittance markets against the CPMI-WB General Principles for International Remittance Services.

Government payments

The Government is typically the largest payer/payee in a country. As such, it is important to design inclusive, efficient and modern payment systems as well as a variety of cost-effective collection/disbursement channels that would facilitate government payments and take into consideration beneficiary choice and convenience. Indeed, the WBG supports countries in the digitization of Government payments in areas such as social protection, e-Government and public financial management reforms. This includes large-scale programs like tax collection, public sector salary payments, public procurement and other Government to Person (G2P) payments, including through cross-sectoral initiatives like G2Px. The WBG has also played a crucial role in facilitating timely and efficient cash transfers during emergencies and crises, most recently during the Ebola crisis in West Africa.

Fintech agenda

In the payment systems domain, the FinTech specific focus is on e-money, fast payment services, central bank digital currencies (CBDC), open banking, tokenization, Quick Response (QR) codes, and policy formulation for crypto-assets and leveraging the underlying technology. In October 2018, the WBG and the IMF launched the Bali FinTech Agenda. Under the Bali Fintech Agenda (BFA), the WBG is supporting countries in developing their fintech ecosystems and advancing the work of the global standard setting bodies. In 2022, the World Bank published a flagship report on Fintech and the Future of Finance.E-commerce payment systems

E-commerce payment systems are digital highways that facilitate the flow of funds between consumers and merchants. Think of these systems as virtual cash registers, enabling us to transact seamlessly from our devices. They bridge the gap between global buyers and sellers, fostering a borderless marketplace.

These payment systems allow businesses to accept payments from customers online, and offer diverse features and benefits to both parties. There are diverse e-commerce payment systems available, each with its pros and cons. The best payment system for a particular business will depend on several factors, like the type of products or services being sold, the target market, and the merchant's budget.

The following explores the most common types of e-commerce payment systems and how they stand globally.

1. Digital wallets

Digital wallets like PayPal, Apple Pay, and Google Pay, have gained substantial popularity recently. These wallets allow users to securely store payment information and complete transactions with remarkable ease. According to Statista and Worldpay, digital wallets began matching credit cards in popularity for the first time in 2020 as the most favoured online payment method in the US—a trend that shows no sign of slowing down.

In 2022, Digital Wallets held a 48.1% market share, and that's expected to rise to 54.1% by 2026. The rise is due to the increased adoption of smartphones and easy-to-use apps worldwide.

Key Benefits of digital wallets- Convenience: Digital wallets eliminate the need for repetitive entry of payment details

- Security: Encryption and authentication mechanisms protect user information

- Speed: E-commerce transactions are expedited, resulting in a seamless checkout experience.

Drawbacks of digital wallets

- Security concerns: Instances of breaches in digital wallets have raised concerns about data vulnerability

- Selective merchant acceptance: Not all merchants universally embrace digital wallets, potentially leading to

- user inconveniences.

2. Credit and debit cards

Credit and debit cards are the second and third most popular payment methods respectively for e-commerce transactions worldwide. For instance, credit cards accounted for 20.0% of the total e-commerce transactions in 2022, and this is expected to decline to 18.1% in 2026. The decline in credit card use is driven by the growing popularity of mobile wallets and merchants' increasing acceptance of digital wallets.

Meanwhile, debit cards accounted for 12% of the total market share of transactions in 2022. This is expected to remain relatively stable in 2026. Debit cards offer the same level of buyer protection as credit cards. However, they do not allow customers to spend more money than they have in their bank accounts.

Benefits of credit and debit cards- Universal acceptance: Virtually all online merchants and platforms support credit and debit card payments

- Accessibility: Credit cards extend lines of credit, while debit cards allow direct spending from accounts

- Security: Credit card companies offer robust fraud protection, safeguarding both consumers and merchants.

Key Challenges of credit and debit cards

- Fraud vulnerabilities: The spectre of credit card fraud persists, potentially rendering consumers liable for unauthorised charges

- Fee structures: Credit card companies occasionally impose substantial fees on merchants, which may be passed on to consumers.

3. Bank transfers

Bank transfers are a type of e-commerce payment system that allows customers to transfer funds directly from their bank account to a merchant's bank account. This is the fourth most popular payment system for e-commerce transactions worldwide. They are relatively less expensive than credit cards. Bank transfers are also generally reliable, making them a top choice for many in some regions globally. For instance, according to the European Central Bank, 45% of e-commerce payments were made via bank transfers in 2020. While this could be linked to the covid-19 pandemic lockdowns, it’s still noteworthy.In terms of global numbers, bank transfers accounted for nearly 9.9% of the 2022 market share. It is, however, projected to decrease marginally to 8.8% by 2026.

Advantages of bank transfers- Cost-effectiveness: Bank transfers often incur lower fees compared to credit card transactions.

- Transparency: Funds are directly transferred between accounts, minimising intermediary involvement.

- Cross-border efficiency: Bank transfers are ideal for international transactions, eliminating currency conversion fees.

Challenges with bank transfers

- Processing time: Bank transfers can take several days to clear, potentially delaying transactions.

- Lack of immediate gratification: In the fast-paced digital world, the delayed processing time of bank transfers might discourage users.

4. Buy now, pay later (BNPL)

Buy now, pay later (BNPL) is a growing trend in e-commerce, with transaction volume expected to reach $725.36 billion by 2030. This type of e-commerce payment system allows customers to split the cost of a purchase into smaller payments over some time. BNPL is becoming increasingly popular as it offers customers a more flexible way to pay for purchases. However, if used irresponsibly, BNPL can also be expensive, leading to debt problems.

Benefits of buy now, pay later (BNPL).- Financial flexibility: Consumers can access products immediately and defer payments

- Streamlined process: BNPL platforms simplify checkouts, circumventing intricate credit checks

- Enhanced conversion rates: Merchants often observe higher conversion rates when offering BNPL options.

Challenges with buy now, pay later (BNPL)

- Overspending/debt concerns: The BNPL model might encourage overspending, potentially leading consumers into debt traps

- Lack of regulatory framework: The BNPL industry is still evolving, lacking standardised regulations in some regions.

5. Mobile payments

Mobile payments are a payment method that allows customers to pay using their mobile phones. They can be made using diverse methods like near-field communication (NFC), QR codes, and voice commands.

Benefits of mobile payments

Convenient: Customers can make payments with a single tap or scan

Secure: Mobile payments use encryption to protect customer payment information

Rising adoption: Mobile payments are becoming increasingly accepted by merchants.

Key drawbacks of mobile payments

Limited coverage: Despite rising adoption, all merchants have yet to accept mobile payments widely

Requires a smartphone: Customers need a smartphone with a mobile payment app to use this payment method

Can be expensive: Mobile payment providers may charge fees for transactions.

6. Cash on delivery (COD)

Cash on delivery (COD) is a payment method where the customer pays for their purchase when it is delivered. The customer typically pays the delivery person in cash or by check. This is a popular payment method in some countries, but it can be inconvenient for customers who have to wait for their purchase to be delivered before they can pay for it.

The saying that cash is king no longer applies to e-commerce payments. While cash remains essential, in 2022, cash-on-delivery payments only accounted for 2% of global e-commerce transactions.

Advantages of cash on delivery (COD)- Familiarity and trust: COD leverages the age-old practice of in-person payment, fostering familiarity and trust among consumers who may be apprehensive about digital transactions.

- Payment flexibility: Cash on delivery accommodates users who prefer cash payments and don't have access to digital payment methods. It also extends financial inclusivity to those without access to banking services.

- Reduced risk for buyers: With Cash on delivery, consumers inspect the product before making the payment, reducing the risk of receiving damaged or incorrect items.

Challenges with cash on delivery (COD)

Customer inconvenience: Customers have to wait for their purchase to be delivered before they can pay for it

Increased delivery costs: Merchants may have to pay higher delivery fees for COD orders

Risky for merchants: There is a risk that customers will not pay for their orders.

7. Cryptocurrency

Cryptocurrency payments, like Bitcoin and Ethereum, introduce a decentralised and groundbreaking approach to e-commerce transactions. It is a digital or virtual currency that uses cryptography for security. A defining feature of a cryptocurrency, and arguably its most endearing allure, is its organic nature. It is not issued by any central authority, rendering it theoretically immune to government interference or manipulation.

While cryptocurrency is used as a payment method for e-commerce transactions, it is not yet widely accepted by merchants. For instance, cryptocurrency e-commerce payments amounted to only $11 billion last year.

Benefits of cryptocurrency- Global connectivity: Cryptocurrency streamlines cross-border transactions sans the burden of currency conversion

- Decentralisation: Transactions unfold directly between users, bypassing intermediaries and their accompanying fees

- Fortified security: Cryptocurrencies incorporate cutting-edge encryption methodologies, heightening resistance against fraudulent activities.

Key challenges with cryptocurrency

- Volatility: The price of cryptocurrency can fluctuate wildly, making it difficult to price goods and services.

- Security: Cryptocurrency transactions do not offer the same fraud protection as traditional payment methods such as credit cards

- Acceptance: Not all merchants accept cryptocurrency as payment.

Choosing a payment system

Selecting the most suitable e-commerce payment system is a strategic decision that businesses must undertake with careful consideration. The evolving landscape, diverse consumer preferences, and dynamic industry trends collectively shape the criteria that guide this pivotal choice.1. Target audience demographics

Understanding the demographics of your target audience is a foundational element. Different generations exhibit varying payment preferences. Younger consumers gravitate towards digital wallets and cryptocurrency, while older segments may lean towards traditional credit cards or bank transfers. Tailoring your payment options to align with your audience's preferences can enhance customer satisfaction and conversion rates.2. Industry type and complexity

The nature of your business significantly influences the choice of payment systems. For instance, high-risk industries might lean towards more secure options like credit cards. Meanwhile, low-cost products could benefit from the convenience of mobile payments or BNPL, streamlining the purchasing process for customers.3. Regional and cultural variations

Geographical considerations are paramount, as payment preferences often vary across regions. Digital wallets dominate in one area, while bank transfers or cash on delivery are favoured in another. Adapting to regional payment norms can foster trust and facilitate smoother transactions.4. Transaction speed and convenience

The speed and convenience of payment methods can impact customer satisfaction. Digital wallets and credit cards offer swift transactions, while bank transfers and cryptocurrency might entail longer processing times. Choosing methods that align with your customers' desire for efficiency can enhance their experience.5. Security measures

Security is non-negotiable in the digital realm. Consumers prioritise payment methods that offer robust security features such as encryption, authentication mechanisms, and fraud protection. Opting for systems with proven security measures safeguards customer data and your business reputation.6. Mobile optimisation

With the proliferation of smartphones, mobile optimisation is a key consideration. Payment systems that offer seamless mobile experiences, such as mobile wallets or mobile banking apps, resonate with users accustomed to making quick purchases on their devices.7. Cost structure

Different payment systems have varying cost structures, including transaction fees and processing charges. Considering these costs is crucial for maintaining healthy profit margins. For instance, credit card transactions often incur higher fees compared to bank transfers.8. User experience

User experience encompasses everything from the checkout process' simplicity to the available payment options. A hassle-free, user-centric experience can significantly impact customer loyalty and brand perception.9. Future-proofing and innovation

As technology evolves, payment methods continually advance. Adopting innovative methods like cryptocurrency or BNPL can position your business as an early adopter and cater to tech-savvy consumers.10. Regulatory compliance

Navigating the regulatory landscape is pivotal, particularly for newer payment methods like cryptocurrency or Buy Now Pay Later. Ensuring that your chosen methods align with regional regulations can avert legal complexities.11. Integration with existing systems

Seamless integration with your existing e-commerce infrastructure, PMS, website or mobile app, is essential for a consistent customer journey. Compatibility ensures that transactions unfold smoothly and without hitches.12. Customer support and returns

When evaluating potential payment partners, prioritising those who excel in customer care can contribute significantly to the success and satisfaction of a business's payment operations.• Electronic billing presentation and payment

Government Policies and Controls on Encryption Software

Private and Private-Public Cooperation EffortsOverview of website security

- E-commerce Marketing Concepts

E-commerce Marketing Concepts

• Consumers online – The Internet audience and consumer behavior

• Basic marketing concepts

• Internet marketing technologies

• B2C and B2B e-commerce marketing and branding strategies

- E-commerce Marketing Communications

E-commerce Marketing Communications

• Understanding the costs and benefits of online marketing communications

• The web site as a marketing communications tool

- Ethical, Social, and Political Issues in Ecommerce

Ethical, Social, and Political Issues in Ecommerce

• Understanding ethical, social, and political issues in e-commerce

• Privacy and information rights

• Intellectual property rights

• Governance

• Public safety and welfare

- Online Retailing and Services

Online Retailing and Services

• Analyzing the viability of online firms

• E-commerce in action – E-tailing business models

• The service sector – offline and online

• Online financial services

• Online traveling services

• Online career services

- Online Content and Media

- Social Networks, Auction, and Portals

Social Networks, Auction, and Portals

• Social networks and online communities

• Online auctions

• E-commerce portals

- B2B E-commerce – Supply Chain Management and Collaborative Commerce

B2B E-commerce – Supply Chain Management and Collaborative Commerce

• B2B e-commerce and supply chain management

• Net marketplaces

• Private industrial networks

- Topic 15